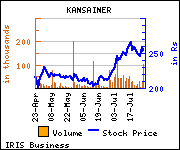

Reliance Securities has maintained 'Buy' on Kansai Nerolac Paints (KNPL) after the announcement of company's first quarter results. The stock broker fixed price target to Rs 270.

Commenting on the results, Reliance Securities said, ''Kansai Nerolac recorded revenue in high single digits, which was primarily volume driven (14% yoy growth). Earnings growth of ~29% yoy was strong, and above expectations, aided by robust margin performance. Post the result, while we have cut our revenue estimates by ~4%/~1% for FY16E/ FY17E to factor lower pricing power owing to contractual nature of their industrial paints business in context to benign crude prices environment, we have revised our margin estimates upwards by ~100bp/120bp for FY16E/17E.''

Commenting on the results, Reliance Securities said, ''Kansai Nerolac recorded revenue in high single digits, which was primarily volume driven (14% yoy growth). Earnings growth of ~29% yoy was strong, and above expectations, aided by robust margin performance. Post the result, while we have cut our revenue estimates by ~4%/~1% for FY16E/ FY17E to factor lower pricing power owing to contractual nature of their industrial paints business in context to benign crude prices environment, we have revised our margin estimates upwards by ~100bp/120bp for FY16E/17E.''

Commenting on the investment rationale, Reliance Securities said ''Post 1QFY16 result, we have cut our revenue estimates by ~4% and ~1% for FY16E/17E, respectively to factor lower pricing power owing to contractual natureof their industrial paints business in context to benign crude prices environment. We have revised our margin estimates upwards by ~100bp and 120bp for FY16E and 17Eto factor 255bp and 80bp gross margin improvement in FY16E/17E, net of ~16% yoy increase in volume and negative price realization (accruing from passed on benefit of softened input cost to the trade). We believe KNPL is in a sweet spot to benefit from expected improvement in the macro economics especially infrastructure industry revival, given that the company is investing behind its greenfield manufacturing capacities. We maintain our Buy recommendation on KNPL with revised target price of Rs 270 from Rs 236 earlier.''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.