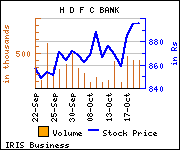

HDFC Bank reported good set of numbers with profit growth of 20.1% yoy to Rs 23.81 billion. Advances growth of 21.8% yoy, which led to 23.1% yoy growth in Net Interest Income. As a result, NIM improved to 4.5% as compared to 4.3% in 2QFY2014. Non-interest income grew by just 11% yoy, leading to operating income growth of 19.6% yoy.

HDFC Bank reported good set of numbers with profit growth of 20.1% yoy to Rs 23.81 billion. Advances growth of 21.8% yoy, which led to 23.1% yoy growth in Net Interest Income. As a result, NIM improved to 4.5% as compared to 4.3% in 2QFY2014. Non-interest income grew by just 11% yoy, leading to operating income growth of 19.6% yoy.

Commenting on the result, Vaibhav Agrawal, VP research, banking, Angel Broking, said, ''Operating expenses grew 19.2% yoy, leading to pre-provisioning profit growth of 19.9% yoy. On the asset quality front, the bank reported slight improvement, as its reported Gross NPA ratio was 1.02% in the current quarter as against 1.07% in 1QFY2015 and 1.09% in 2QFY2014. At the CMP, the stock is trading at 3.5x FY2016E ABV. We recommend Accumulate rating on the stock.''

Commenting on the result, Vaibhav Agrawal, VP research, banking, Angel Broking, said, ''Operating expenses grew 19.2% yoy, leading to pre-provisioning profit growth of 19.9% yoy. On the asset quality front, the bank reported slight improvement, as its reported Gross NPA ratio was 1.02% in the current quarter as against 1.07% in 1QFY2015 and 1.09% in 2QFY2014. At the CMP, the stock is trading at 3.5x FY2016E ABV. We recommend Accumulate rating on the stock.''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.