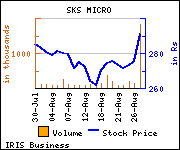

Morgan Stanley Research has reiterated 'Overweight' on SKS Microfinance with a price target of Rs 385 as against the current market price (CMP) Rs 290 in its report dated Aug. 27, 2014.

Commenting on the same, Morgan Stanley, said, ''We estimate 65% EPS CAGR for F14-17, with average ROE of 23%, the best in our coverage, which should help sustain, if not re-rate, valuation.

India’s microfinance industry, we estimate, holds USD 90 billion demand potential. Only 15% of this is being addressed, implying strong growth, especially as new rules have quelled concerns of borrower overleveraging, high pricing, and process dilution. Credit bureaus have also improved underwriting, reviving funding lines.

India’s microfinance industry, we estimate, holds USD 90 billion demand potential. Only 15% of this is being addressed, implying strong growth, especially as new rules have quelled concerns of borrower overleveraging, high pricing, and process dilution. Credit bureaus have also improved underwriting, reviving funding lines.

SKS, India's second-largest microfinance institution (MFI), operating across 15 states, and the sole large Andhra Pradesh (AP) based MFI lender not to restructure its debt since the industry's 2010 downturn, faces a favorable landscape, as new industry rules benefit large and diversified MFIs. Loan spreads, for example, are now capped at 10%, so lowering operating costs are key to raising ROA, and the rules also restrain competition in mature states. Given SKS' 40% tier 1 capital ratio, we expect it to achieve a high 37% AUM CAGR, F14-F17.

We forecast a 25% F17 ROE up from F14's 17%, aided by operating and financial leverage. This compares with our private financials coverage average of 19%. Higher fees, scale, better technology could yield up to 30% bull-case ROE.

SKS' medium-term growth and ROE (best in our coverage) should drive share price performance in a stable macro climate. Within our coverage, we prefer private banks and NBFCs (in that order) to SOE banks. Our 12-month price target at 3.3x one-year forward P/B and 16x P/E, implies little re-rating.

Given the segment's rocky 2010, such risk will likely be ongoing. But we believe RBI norms issued in 2011 pave a sustainable path - and the RBI's move to award a bank license to an MFI indicates that regulators support the MFI model.''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.