CRISIL has enhanced the rated amount while retaining 'AA-/stable/A1+' ratings on the bank facilities of Balkrishna Industries (BIL). The rated amount enhanced to Rs 13.15 billion from Rs 12.9 billion for total bank loan facilities. "The rating continues to reflect BIL's sound operating efficiency, improving product portfolio, increasing market share in the global off-highway tyre (OHT) market, and adequate financial risk profile, marked by healthy cash flows and adequate debt protection metrics."

CRISIL believes that BIL will continue to benefit over the medium term from expanding markets, improved product mix, and increasing capacities along with its established brand and sound operating efficiency. The outlook may be revised to 'Positive' if BIL achieves strong growth in turnover and increases its global market share in the OHT segment on a sustained basis, while maintaining a healthy operating margin.

CRISIL believes that BIL will continue to benefit over the medium term from expanding markets, improved product mix, and increasing capacities along with its established brand and sound operating efficiency. The outlook may be revised to 'Positive' if BIL achieves strong growth in turnover and increases its global market share in the OHT segment on a sustained basis, while maintaining a healthy operating margin.

"Conversely, the outlook may be revised to 'Negative' in case of slower-than-expected ramp-up of capacity in its Bhuj project or significant increase in its working capital borrowings, or if the company adopts a more aggressive policy to fund its capital expenditure programmes, thereby adversely impacting its gearing and debt protection metrics," the rating agency said.

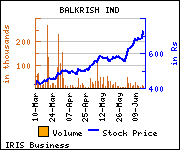

Shares of the company gained Rs 66.15, or 9.63%, to trade at Rs 753.00. The total volume of shares traded was 22,679 at the BSE (2.00 p.m., Tuesday).