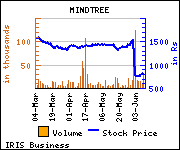

ICICIdirect has downgraded MindTree to 'Hold' with target price of Rs 790 as against current market price (CMP) of Rs 809 in its report.

ICICIdirect has downgraded MindTree to 'Hold' with target price of Rs 790 as against current market price (CMP) of Rs 809 in its report.

Commenting on the investment rationale, the stock broker said, ''We attended, MindTree's (MTL) analyst day in Bengaluru yesterday where the management highlighted its efforts in readying MTL for the future. In his crisp keynote speech, the CEO articulated their vision of becoming a dominant player in multi-specialty segments, which, by 2020, could comprise 20-25 global players with revenues of USD 2-5 billion each.

Overall, the company reiterated its FY15E>FY14 and Q1FY15E>Q4FY14 revenue growth commentary led by scaling deeper into its four key verticals, BFSI - data analytics and data automation services, Hi-Tech (Oracle/SAP and agile technology), retail, CPG and manufacturing (remote infrastructure and digital) and 4) travel & transport (mobile and cloud), improved deal wins, healthy order backlog and top account mining.

Overall, the company reiterated its FY15E>FY14 and Q1FY15E>Q4FY14 revenue growth commentary led by scaling deeper into its four key verticals, BFSI - data analytics and data automation services, Hi-Tech (Oracle/SAP and agile technology), retail, CPG and manufacturing (remote infrastructure and digital) and 4) travel & transport (mobile and cloud), improved deal wins, healthy order backlog and top account mining.

MTL continues to be the best managed midcap but earnings sensitivity to rupee - an FY16E unknown - could drive earnings downgrades. Consequently, we would wait for attractive entry points.

Demanding valuations cap upside; downgrade to 'Hold'. We estimate MTL will report revenue, earnings CAGR of 14%, 16%, respectively, over FY14-16E (average 20.2% EBITDA margins in FY15-16E), vs. 20%, 54% reported during FY09-14 (average 15.9%), given IT services refocus and anticipated acceleration in hi-tech vertical. We continue to value MTL at Rs 790 i.e. at 11.2x its FY16E EPS of Rs 70.4.''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.