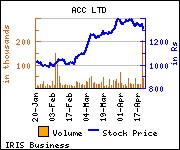

HDFC Securities has maintained 'Sell' on ACC with target price of Rs 1,132 as against current market price (CMP) of Rs 1,307 in its report.

HDFC Securities has maintained 'Sell' on ACC with target price of Rs 1,132 as against current market price (CMP) of Rs 1,307 in its report.

Commenting on the investment rationale, the stock broker said, ''ACC earnings lagged our estimates (EBITDA/t at Rs 564/t vs. estimated Rs 600/t). Realizations were flat (Rs 4,304/t, 0.8% YoY, flat QoQ), as gains in North/Central were offset by declines in South where prices receded.

Volumes remain sluggish (6.48 mT, 0.9% YoY) and are still shy of the 1QCY12 peak (6.72mTPA). This is ACC's biggest hurdle, given the next capacity addition is still 4-5 quarters ahead and south exposure implies utilizations of existing capacity will remain range-bound.

Volumes remain sluggish (6.48 mT, 0.9% YoY) and are still shy of the 1QCY12 peak (6.72mTPA). This is ACC's biggest hurdle, given the next capacity addition is still 4-5 quarters ahead and south exposure implies utilizations of existing capacity will remain range-bound.

We do not expect ACC to close the profitability gap with its peers anytime soon, which implies a continued discount on the valuations. While the stock may appear inexpensive on capacity (US$110 on CY15 end capacity), earnings based valuations are stretched (12x EV/EBITDA) with a likelihood of further downward revision.

Despite a strong improvement in prices in North/Central in 1QCY14, ACC realizations remained flat due to decline in South. This outlines a peculiar problem the pan-Indian companies face, that of constrained available volume growth. On top of this ACC, is not expected to add any capacity in the near term (benefits of East expansion to be available in CY16 only). Legacy costs will ensure profitability gap will continue and ACC's valuations will have to suffer as a consequence. We maintain our 'Sell' rating on ACC, with a target price of Rs 1,132 (9x CY15 EV/EBITDA, USD 95/t).''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.