Moody's Investors Service says that Bharti Airtel (Baa3, stable) decision to sell approximately 4,800 of its telecommunications towers in Nigeria is credit positive. ''This transaction is credit positive as it will allow Bharti to pay down balance sheet debt, reduce its interest cost, and reduce total capital expenditure on passive infrastructure investments,'' says Annalisa DiChiara, a Moody's vice president and senior analyst.

Moody's Investors Service says that Bharti Airtel (Baa3, stable) decision to sell approximately 4,800 of its telecommunications towers in Nigeria is credit positive. ''This transaction is credit positive as it will allow Bharti to pay down balance sheet debt, reduce its interest cost, and reduce total capital expenditure on passive infrastructure investments,'' says Annalisa DiChiara, a Moody's vice president and senior analyst.

''Moreover, it is in line with the company's strategy to divest strategic but non-core assets, thus allowing it to focus on its strategic business as a cellular telecommunications operator, as well as pare down debt,'' adds DiChiara, also Moody's Lead Analyst for Bharti.

''Moreover, it is in line with the company's strategy to divest strategic but non-core assets, thus allowing it to focus on its strategic business as a cellular telecommunications operator, as well as pare down debt,'' adds DiChiara, also Moody's Lead Analyst for Bharti.

On November 24, Bharti announced that it had entered into a definitive agreement with American Tower Corporation (ATC, Baa3 negative) - through its subsidiary, Bharti Airtel International Netherlands BV - to sell around approximately 4,800 of its towers in Nigeria. ATC in its SEC filings stated the transaction consideration of c. USD 1.05 billion.

The transaction follows two other deals on its towers in Africa: first in July, when it agreed to sell 3,100 towers to Helios Towers (unrated); and second in September, when it agreed to sell another 3,500 to Eaton Towers (unrated).

Moody's notes that with the Nigerian deal, the company has now agreed to sell over 75% of its portfolio of around 15,000 towers in Africa.

The sales to Eaton and Helios are for undisclosed sums, while the total of USD 1.05 billion for the sale to ATC translates to over USD 200,000 per tower. All three transactions are still subject to statutory and regulatory approvals in their respective countries.

Moody's expects the majority of proceeds-once they are received-to be deployed towards the repayment of balance sheet debt. Total reported bank and bond debt outstanding as of 30 September was Rs 677 million, including the deferred liability of INR 71.9 billion of spectrum related commitments.

But, as Bharti plans to lease space off the towers under long-term contracts, the transactions - on a Moody's lease-adjusted basis - may ultimately be leverage neutral, based on adjusted debt/EBITDA metrics. Adjusted debt/EBITDA as of September 30 was 2.7x.

That said, the company's proactive steps to reduce absolute debt will also help reduce interest costs and if applied to USD debt, decrease its foreign-currency risk exposure further.

At end-March 2014, around 60% of its total outstanding debt was denominated in US$, while its cash flows are largely rupee-denominated.

Already this year, the company has used proceeds from the Bharti Infratel Offer for Sale that raised RS 21,395 million (USD 348.8 million) to pay down a portion of its USD debt. As a result, we believe Bharti's level of exposure to the USD has already improved considerably, and the proportion of USD denominated debt will trend towards 40% by end March 2015, a development which we view positively.

Over the medium term, the three tower sale transactions, and the development of a thriving independent tower network across the African continent, will provide additional benefit to Bharti as it will allow the company to strengthen its operations without incurring material capital expenditure costs for tower builds.

To this extent, we note that many telecommunications operators across Africa are now shifting towards leasing and co-leasing towers rather than outright ownership.

This is because maintenance costs are usually more expensive than in other regions. These high costs are partly because of security costs and the impact of electricity shortages.

For example, in September, MTN Group Limited (Baa2, stable) announced that it had agreed to transfer the operation of its network of mobile towers - which total 9,151 - in Nigeria to IHS, a Nigeria-based mobile infrastructure company.

And in August, the UAE's state-owned telecoms group Emirates Telecommunications Corporation (Etisalat, Aa3, stable) agreed to sell and lease back its 2,136 towers in Nigeria to IHS.

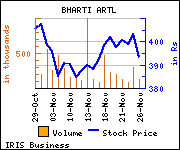

Shares of the company declined Rs 6.35, or 1.61%, to trade at Rs 387.00. The total volume of shares traded was 117,861 at the BSE (2.46 p.m., Thursday).