India Ratings and Research (Ind-Ra) has affirmed Steel Authority of India (SAIL) long-term issuer rating at 'AAA'. The outlook is negative.

India Ratings and Research (Ind-Ra) has affirmed Steel Authority of India (SAIL) long-term issuer rating at 'AAA'. The outlook is negative.

The ratings reflect SAIL's leadership in the domestic steel industry with an established brand, country-wide sales network and presence in almost the entire range of mild steel products.

Ind-Ra expects SAIL's EBITDA/t to increase to Rs 5,500-Rs 6,000 in FY16 and further over FY17-FY18 driven by a) improved net sales realisation as the product mix changes towards higher value-added products b) better absorption of fixed costs (primarily employee cost) as volume picks up post capacity expansion and c) an improvement in the techno-economic parameters such as coke rate, specific energy consumption and coal dust injection rate. Also, a decline in global coking coal prices will boost EBITDA/t as SAIL imports 80% of coking coal. EBITDA/t for 9MFY15 improving to INR4,300/t is a positive.

Ind-Ra expects SAIL's EBITDA/t to increase to Rs 5,500-Rs 6,000 in FY16 and further over FY17-FY18 driven by a) improved net sales realisation as the product mix changes towards higher value-added products b) better absorption of fixed costs (primarily employee cost) as volume picks up post capacity expansion and c) an improvement in the techno-economic parameters such as coke rate, specific energy consumption and coal dust injection rate. Also, a decline in global coking coal prices will boost EBITDA/t as SAIL imports 80% of coking coal. EBITDA/t for 9MFY15 improving to INR4,300/t is a positive.

The Negative Outlook reflects Ind-Ra expectation of a muted pick-up in demand as the industry continues to grapple with domestic overcapacity leading to a low utilisation level and cheap imports from China and other countries. This will add to pressure on realisations. Additionally, the full benefits of the upgradation and capacity expansion are yet to be seen through in the company's operating performance. Ind-Ra expects a gradual pick-up in volumes on increasing spend on infrastructure by the government and growth in the auto sector, among other reasons.

The government of India owns 75% of SAIL and has demonstrated strong financial support. The 'Maharatna' status of the company provides it considerable financial and operational autonomy.

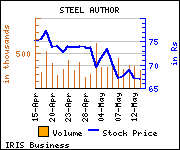

Shares of the company gained Rs 0.4, or 0.6%, to trade at Rs 67.35. The total volume of shares traded was 97,577 at the BSE (11.23 a.m., Thursday).