Mukesh Ambani led Reliance Industries (RIL) reported on Friday a better-than-expected growth in standalone net profit for the fourth quarter of financial year 2015. During the quarter, earnings went up 10.87% over prior year period to Rs 62.43 billion. Analysts had predicted profit at Rs 60 billion.

RIL has posted wider-than-expected fall in quarterly revenue on standalone basis. Its revenue for the quarter plunged 40.17% over previous year period to Rs 581.76 billion. Analysts had predicted profit at Rs 650 billion. 'Sharp year-on-year fall in benchmark oil price of around 50% was the key factor for the decline in revenue,' the company said.

On the other hand, the company's consolidated March quarter profit rose 8.5% over prior year period to Rs 63.81 billion. However, revenue for the quarter declined 34% over previous year period to Rs 696.42 billion.

On the other hand, the company's consolidated March quarter profit rose 8.5% over prior year period to Rs 63.81 billion. However, revenue for the quarter declined 34% over previous year period to Rs 696.42 billion.

Gross refining margin (GRM) for fourth quarter stood at USD 10.10 a barrel compared with analyst expectations of USD 9.90 a barrel.

RIL achieved a turnover of Rs 3884.94 billion for the year ended Mar. 31, 2015, a decrease of 13%, as compared to Rs 4463.39 billion in the previous year. Profit after tax was higher by 4.8% at Rs 235.66 billion as against Rs 224.93 billion in the previous year.

The decline in turnover reflects sharp fall in crude oil prices during the second half of the year. Crude oil price averaged at USD 85.4 a barrel in FY15, a fall of 21% on year-on-year basis.

Mukesh D. Ambani, chairman and managing director, Reliance Industries said, ''FY 2014-15 has been a very successful and important year for Reliance. In a time when the collapse of crude oil prices unsettled the hydrocarbons markets, our refining business delivered record earnings. The earnings power demonstrated by our hydrocarbon businesses in this environment validates our philosophy of investing in world-scale, cost competitive assets, cutting-edge technology and the talent of people. This year we also made giant strides in our quest to sustain Reliance's growth momentum with the highest-ever capital investment into our hydrocarbon business and our next-generation digital services initiative. Our organized retail business maintained its high growth trajectory with a wider pan-India footprint. Particularly gratifying, we achieved this, while maintaining our track-record of adhering to highest standards of safety and operational excellence.''

Outstanding debt as on Mar. 31, 2015 was Rs 1608.60 billion compared to Rs 1387.61 billion as on Mar. 31, 2014. Cash and cash equivalents as on Mar. 31, 2015 were at Rs 844.72 billion. These were in bank deposits, mutual funds, CDs and government bonds and other marketable securities, it said.

The capital expenditure for the year ended Mar. 31, 2015 was Rs 1002.47 billion including exchange rate difference capitalization.

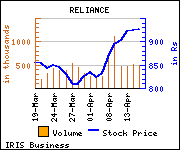

Shares of the company declined Rs 0.6, or 0.06%, to settle at Rs 926.85. The total volume of shares traded was 462,394 at the BSE (Friday).